Exactly How a 2D Payment Gateway Enhances Security and Effectiveness in Ecommerce

Exactly How a 2D Payment Gateway Enhances Security and Effectiveness in Ecommerce

Blog Article

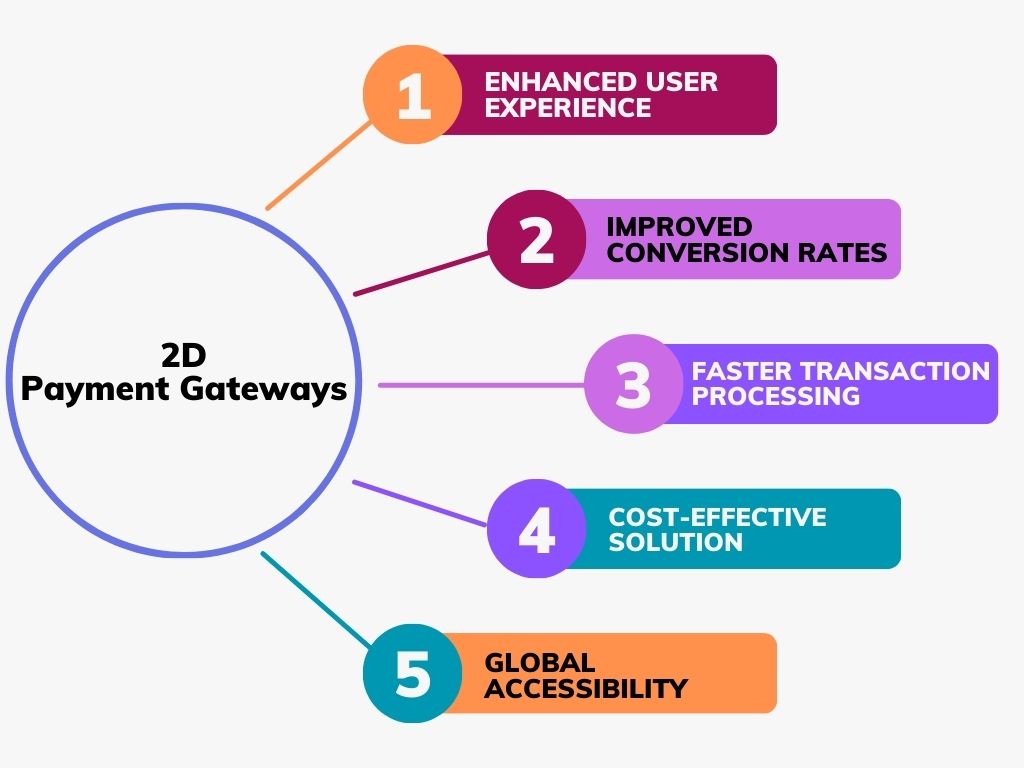

Discovering the Conveniences and Qualities of a Versatile Settlement Portal for Seamless Transactions

In today's digital economic climate, the choice of a repayment entrance can dramatically affect the client experience and general company success. A flexible payment gateway not just uses improved safety functions to safeguard sensitive information however likewise offers multiple payment alternatives customized to diverse consumer needs. Paired with a straightforward interface and robust assimilation abilities, such options are developed to enhance deals. However, the actual concern depends on just how these functions translate into tangible advantages for companies and their clientele. Exploring this more reveals intricacies that require closer exam.

Boosted Security Functions

In the electronic age, enhanced safety attributes are paramount for repayment entrances, making certain the protection of sensitive financial data. As on-line transactions proliferate, the danger of information violations and fraud increases, making robust safety measures necessary for both consumers and companies. Repayment entrances utilize numerous layers of protection methods, including file encryption, tokenization, and secure outlet layer (SSL) technology, to safeguard transaction data during processing.

Encryption converts sensitive information right into unreadable code, preventing unauthorized accessibility during transmission. Tokenization even more boosts security by changing delicate information with special identification signs or tokens, which can be used for processing without exposing the initial information. In addition, SSL certifications establish protected connections between the individual's browser and the server, making certain that information traded remains confidential.

Moreover, conformity with sector requirements such as the Payment Card Sector Information Safety Standard (PCI DSS) is essential for payment portals. Sticking to these standards not just assists safeguard versus safety vulnerabilities but additionally promotes trust amongst individuals. Ultimately, the execution of sophisticated safety and security attributes within repayment portals is crucial for maintaining the honesty of monetary purchases and making certain a safe on-line buying experience.

Numerous Repayment Alternatives

Providing numerous repayment choices is necessary for accommodating varied customer choices and enhancing the general purchasing experience. A flexible settlement gateway allows companies to incorporate various repayment approaches, including credit report and debit cards, electronic purses, financial institution transfers, and also cryptocurrencies. This versatility not just provides to a bigger audience however additionally increases client contentment and loyalty.

Along with suiting client preferences, a durable payment portal can improve the purchase process, permitting quicker checkouts and reducing rubbing throughout the repayment phase. This effectiveness is essential in today's busy e-commerce setting, where consumers expect smooth deals.

Inevitably, providing a range of settlement options not just enhances individual experience yet also settings organizations to stay affordable in a swiftly developing electronic landscape. Embracing this convenience is a tactical action that can yield considerable rois.

User-Friendly User Interface

An efficient customer interface integrates clear navigation, aesthetically appealing style, and click for more easily well-known buttons. These components overview customers effortlessly through the settlement process, lessening the risk of desertion. In addition, the interface needs to offer real-time responses, such as confirmation messages or mistake notifies, which educates users of their deal standing and assures them that their delicate details is protected.

In addition, an user-friendly repayment portal accommodates various individual preferences, such as language choices and ease of access functions. This inclusivity not only expands the client base but also improves total user fulfillment - 2D Payment Gateway. By focusing on an user-friendly interface, services can cultivate trust and loyalty, ultimately causing boosted earnings and lasting success

Assimilation Capacities

Effective integration capabilities are necessary for any kind of settlement portal, as they determine how seamlessly the system can connect with existing company applications and systems. A functional settlement portal need to sustain numerous assimilation techniques, consisting of APIs, SDKs, and plugins, which allow businesses to incorporate settlement processing into their web sites, mobile applications, and shopping systems with very little interruption.

Robust integration alternatives make it possible for organizations to take advantage of their existing facilities while boosting capability. The capability to integrate with preferred shopping platforms such as Shopify, WooCommerce, and Magento is particularly beneficial, as it streamlines the repayment process for clients and vendors alike. Additionally, compatibility with consumer connection management (CRM) systems and venture source planning (ERP) software program enhances operations, cultivating better information administration and coverage.

Furthermore, a payment portal that supports numerous shows languages and frameworks provides companies the versatility to personalize the combination according to their distinct requirements. This adaptability not just boosts customer experience however likewise permits quicker modifications and updates, guaranteeing that businesses can respond to advancing market needs successfully. Eventually, strong assimilation capacities are crucial for organizations looking for to enhance their payment procedures and enhance overall functional performance.

Improved Deal Speed

Smooth combination capabilities prepared for accomplishing improved transaction rate within a payment portal. By making sure compatibility visite site with various shopping platforms and systems, businesses can promote reliable and quick settlement handling. This structured integration lessens the time called for to complete purchases, ultimately boosting the customer experience.

One more considerable element of improved transaction speed is the reduction of hand-operated intervention. Automated processes reduce human mistake and quicken the confirmation and permission stages, enabling instantaneous approvals - 2D Payment Gateway. basics In addition, the use of durable APIs allows seamless communication in between various systems, additionally improving transaction performance

Verdict

In final thought, a versatile repayment gateway significantly improves purchase processes via its durable safety attributes, diverse repayment alternatives, and intuitive interface. The relevance of selecting an efficient settlement entrance can not be overemphasized, as it plays a critical function in the success of on-line transactions.

A functional settlement gateway not only uses boosted security functions to secure delicate information but likewise supplies numerous settlement alternatives tailored to diverse consumer requirements.Additionally, conformity with sector standards such as the Payment Card Industry Data Protection Standard (PCI DSS) is important for repayment portals. A functional settlement portal allows services to incorporate numerous settlement techniques, consisting of credit rating and debit cards, digital wallets, bank transfers, and even cryptocurrencies. When consumers encounter a repayment gateway that is uncomplicated and user-friendly, they are a lot more likely to complete their transactions without aggravation.In conclusion, a versatile settlement portal substantially enhances transaction procedures via its durable safety and security features, varied settlement choices, and intuitive user interface.

Report this page